Sustainability Indices and Ratings

ESG RATING

The Group's market positioning in terms of sustainability has significantly strengthened in recent years due to ongoing

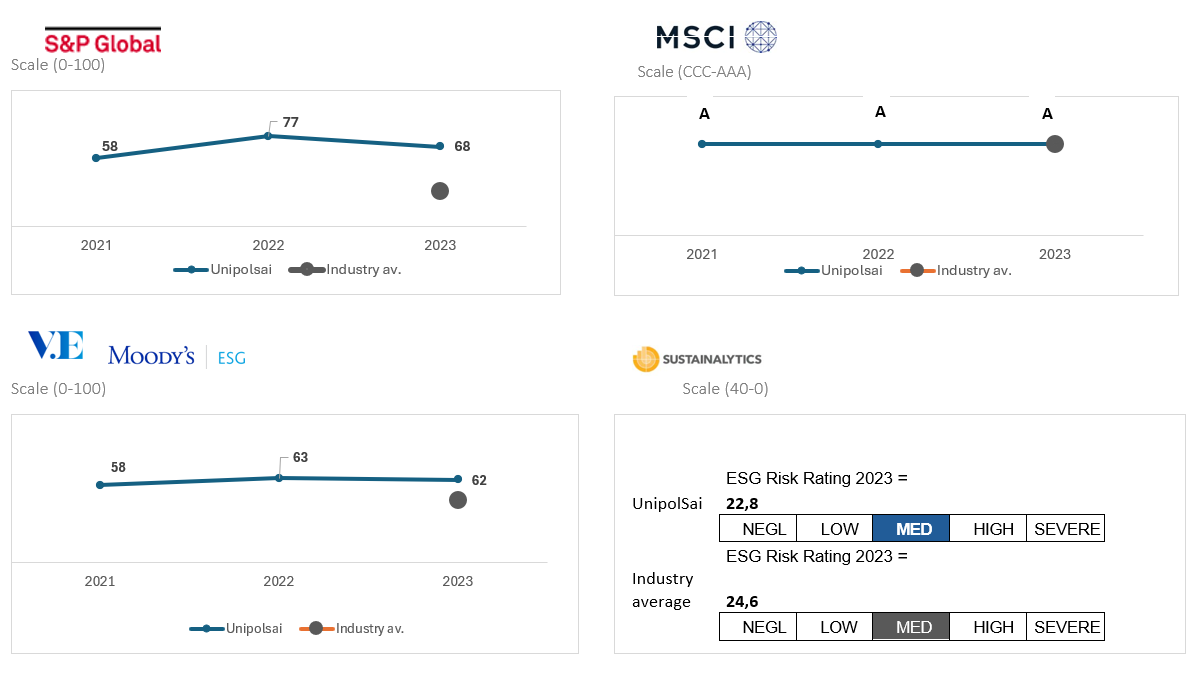

Following a significative methodological change impacting the score of the entire insurance sector, UnipolSai Assicurazioni achieved a score of 68/100 in 2023. The company ranks in the top quartile among its insurance industry peers (INS) and was also included in the S&P Global Sustainability Yearbook 2024, which highlights the world's leading companies based on their sustainable business practices.

Unipolsai Assicurazioni achieved the rating of 'A' in the MSCI ESG Ratings assessment 2023. The Parent Company Unipol Group is included in a few ESG indexes, including the following: Europe Small ex Controv Weapons and ACWI IMI Low Carbon Target.

UnipolSai, in the latest assessment, achieved a score of 62. Furthermore, since 2021, the Parent Company, Unipol has been listed in the Moody’s MIB ESG index.The MIB® ESG index is the leading ESG (Environmental, Social and Governance) index dedicated to blue-chip Italian companies, created to identify big, listed Italian issuers who show best ESG practices.

Sustainalytics carries out an ESG analysis mainly focused on corporate governance, analyzing over 13,000 companies. In the latest assessment, UnipolSai achieved a score of 22,8 positioning itself in the ranking of medium-risk companies in line with the sector.

The parent Company, Unipol Gruppo takes part in the annual ‘Carbon Disclosure Project’ on climate change, showing the data on the performance, policies and practices relating to the impacts and opportunities linked to climate change in the context of our company activities. Unipol Group had a “B” rating for Climate Change in the latest assessment (year 2022).