Opening New Ways Strategic Plan 2022-2024

Assets

Brand &

Reputation

Reputation

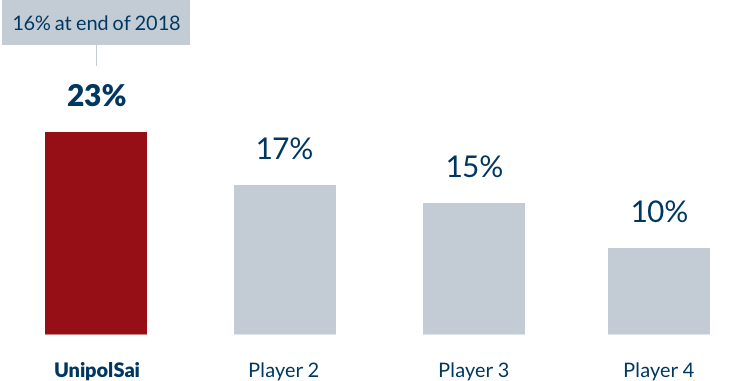

UnipolSai compared to the Insurance Sector:

‘Top of Mind’ December 2021*

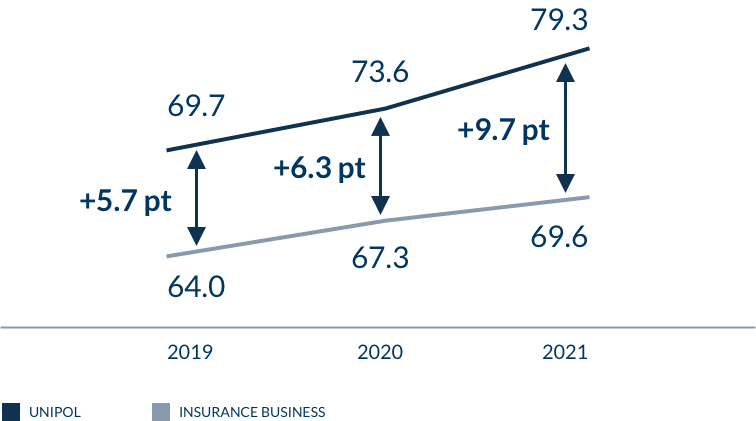

Unipol compared to the Insurance Sector: reputation trends with the general public**

1 out of 4 Italians cites UnipolSai as the first insurance company that comes to mind (Top of Mind)

Unipol at maximum reputation levels in the insurance sector

High credibility for innovative and evolving initiatives

* Source: First operator spontaneously mentioned - Research on the reputation and brand equity of insurance companies in Italy - Demoskopea Consulting - Research Custom Unipol 2021 ** Source: RepTrak®- Research Custom Unipol 2019-2021

15.5 mln

Group Customers

Group Customers

70% Customers with digital interaction

4 mln apps downloaded

170 mln minutes spent on digital touch points

1 direct communication with Customers every 10 days

75% contactable Customers

The size of the Customer Base enhances the Insurance strategy and enables ecosystems approach

Strong Customer engagement: most used app in the Italian insurance market, high levels of digital interaction and significant communication frequency

4,000

TeraByte of Data

TeraByte of Data

Over 4 mln telematic devices

11 mln telematic services provided

3.7 bn journeys recorded

Artificial Intelligence

800 mln interactions on Digital Touch Points

25 mln logins on Digital Touch Points

Insurance Value Chain

Over 10 mln

vehicles insured

vehicles insured

Distinctive Offer in terms of insurance and beyond insurance services

Over 90 variables for motor pricing

Injuries management model

800,000 post-accident interventions provided directly

> 700,000 spare parts intermediated

2,700 UnipolService body repair shops, 215 UnipolGlass centres

Premium positioning in terms of offering a wide range of coverages and services

Motor TPL market leader:

- - Current year Loss Ratio* (63.5% compared to 69.6%) - Current year settlement speed** (77.3% compared to 73.9%) - Current year average cost of paid claims** (€2,607 compared to €2,843)

Full supervision of the claims management process to ensure financial efficiency and transparency

* UnipolSai compared to industry average (excluding UnipolSai); source: ANIA, 2020 figures ** UnipolSai compared to industry average (excluding UnipolSai); source: IVASS, 2020 figures

11 mln

Customers

Customers

€750m premiums

Over 500 Operators Proprietary telephone operations centre

51 healthcare funds managed

60 doctors in the company

4.3 mln claims managed

Over 20,000 affiliated medical centres in Italy and abroad

Leading Group in the Italian Health business

Single integrated model of insurance management and service development

Network with the best public and private affiliated healthcare facilities

Direct provision of services offered by UniSalute

> 2,100

Agencies

Agencies

Agreement 2.0 Partnership with the Network

30,000 professionals

750,000 leads from digital channels

~ 600 agents under 45

2,000 Insurance and Beyond Insurance specialists

8,000 sales points on average reachable within 10 minutes from home

Consolidated partnership based on shared strategy, targets and economics

Specialisation of the Agency Network overseeing the different market segments

High-Performing distribution network including for the Beyond Insurance initiatives

Banking

Networks

Networks

2,612 Number of branches

~5.9 mln Customer

~10% Non-Life Insurance penetration *

Unique bancassurance model (Arca Vita and Arca Assicurazioni are dedicated companies with about 400 employees) that enhances Unipol Group assets in favour of the banking partners

Strong oversight of the banking channel in terms of both local presence and target customers

* Estimate based on BPER and BP Sondrio customer base

Direttrici Strategiche

Consolidate the Group's technical and distribution excellence, through an increasingly intensive use of Data and Analytics

Develop a new platform for the Retail insurance offer, by exploiting the effectiveness of the leading agency network and completing the omnichannel evolution of the distribution model

Strengthen leadership in the health business by enhancing the UniSalute centre of excellence in support of all the Group's Distribution Networks

Life products offer with a Life-Cycle perspective and optimised capital absorption

Strengthen the bancassurance business model by enhancing the Group’s distinctive capabilities for the benefit of the banking partners

Accelerate the evolution of the Group’s offer by further extending the Mobility ecosystem and strengthening the Welfare and Property ecosystems

Digital evolution in the operating model through intensive use of new technologies, data, automation and the evolution of the company’s organisation

Target e KPI

| 2024 Target | Δ vs 2021 | |

|---|---|---|

| Non-Life Premiums | €8.9bn | + 4.5% CAGR |

| of which Motor | €4.2bn | + 3.1% CAGR |

| of which non-Motor* | €3.7bn | + 4.7% CAGR |

| of which Health | €1.0bn | + 10.0% CAGR |

| CoR Non-Life (net of reinsurance) | 92.6 % | - 2.7 p.p. |

| Life premiums | €5.8bn | + 2.5% CAGR |

| Present Value Future Profit Margin | 3.5 % | + 0.5 p.p. |

* Excludes Health Business

| Unipol Group 2022-2024 TARGET |

UnipolSai 2022-2024 TARGET |

|

|---|---|---|

| Cumulative consolidated net profit* 2022-2024 | €2,3bn | €2,3bn |

| Cumulative dividends 2022-2024 | €0.75bn | €1.4 bn |

| 2024 Target |

||

| Share of products with environmental and social value by 2024 | 30% | |

| Finance for the SDGs (increase in amount of thematic investments for the SDGs) |

€1.3bn | |

| Reputational Index (reputation score among the general public according to RepTrak® methodology) |

> Average insurance business | |

| Unipol management incentive system | 20% incentive long-term system linked to ESG targets | |

* Consolidated normalised profit (excluding Employee Solidarity Fund) calculated on the basis of current accounting standards